Stock of the week: Sunnova Energy International Inc.

Sunnova provides clean, affordable, and reliable energy for homes and businesses.

Established in Houston, Texas in 2012, Sunnova aims to deliver superior service at a better price. As a leader in the energy transition, Sunnova is committed to a sustainable future.

Sunnova CEO, William J. (John) Berger, highlighted the company's long-term focus on building a robust service infrastructure to ensure the smooth operation of customers' solar energy systems. He acknowledged the importance of exceptional service to earn customers' trust, especially with the increasing number of solar energy adopters. Sunnova's commitment to service excellence has enabled them to remain at the forefront of the industry.

In September 2023 Sunnova signed a $3.0 billion loan guarantee agreement with the U.S. Department of Energy to support solar loans originated by Sunnova under a new solar loan channel named "Project Hestia". This project aims to provide disadvantaged homeowners and communities increased access to clean, flexible power via Sunnova services. Sunnova's purpose-built technology will improve customer insights regarding their power usage and facilitate demand response behaviour, while expanding access to Sunnova’s adaptive energy platform, decreasing greenhouse gas emissions, and increasing the demand response benefits of residential power systems.

Sunnova continues to make waves in the Solar Industry through its recent expansion of its Global Command Center, providing exceptional customer service and cost efficiency, reducing the travel time of technicians between assignments while serving an extensive customer base of over 380,000 across all 55 U.S. States and territories.

The future for Sunnova Energy Inc. looks bright as the world edges closer to its carbon footprint goals.

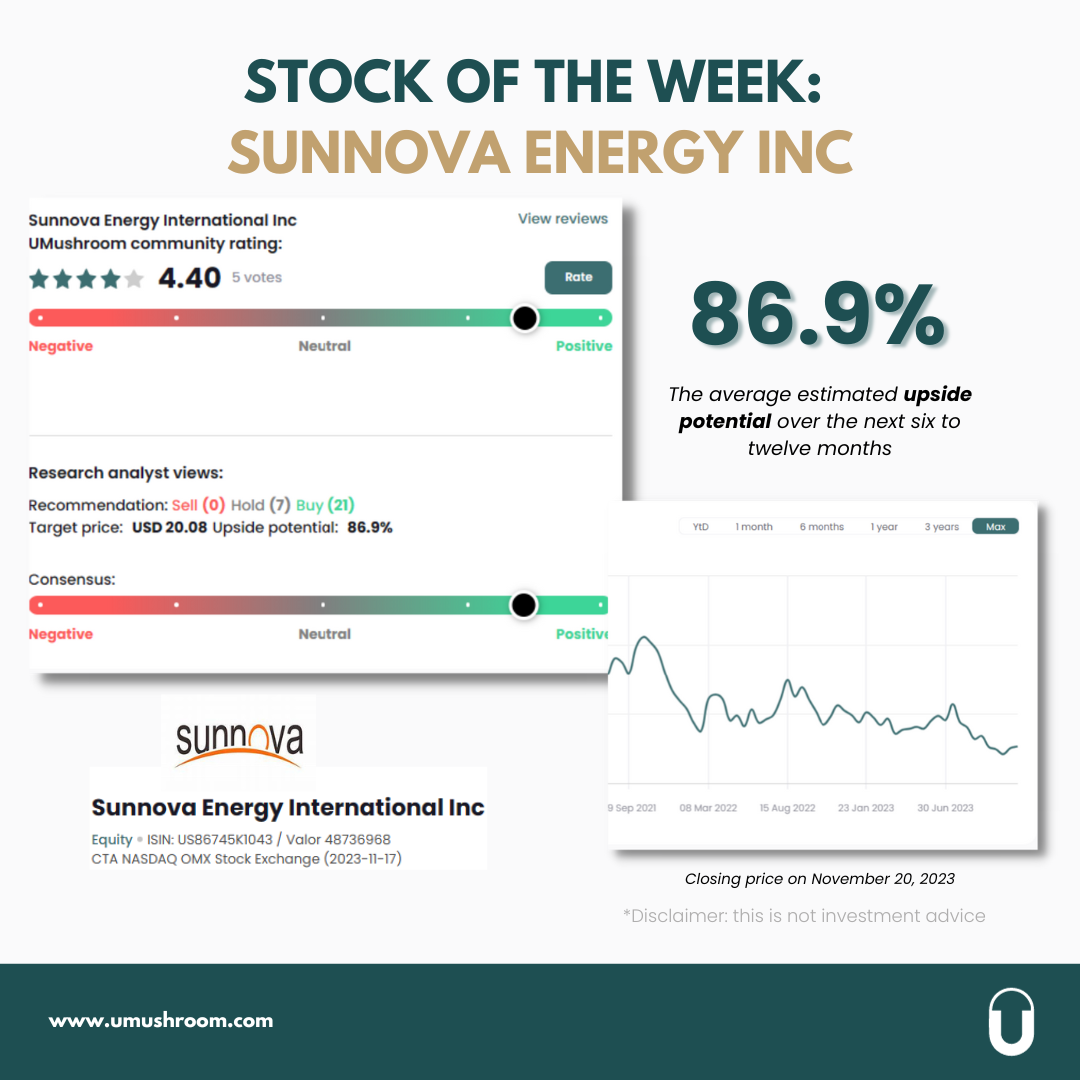

And this is how the bank research analysts view the stock currently:

· The consensus of the bank analysts is "buy." Of 28 analysts covering the share, twenty-one (21) rates the stock with "Buy" and seven (7) with "Hold.” No analyst recommends selling the stock.

· The average expected upside of the stock price for the next six to twelve months is currently 86.9% (closing price on 21/11/2023)

Sources:

Sunnova - Sunnova Drives Clean Energy Transformation in Puerto Rico

Sunnova Energy International Inc | US86745K1043 | 48736968 | UMushroom